This year, United States President “Joe Biden” has his office desk full with paper work when it comes to senior citizen’s Social Security. Just as the numbers of retiring workers in the US keeps growing, the Social Security Trust Fund is losing so much money. This growth is among the large part of increased longevity of workers. As currently structured, the trustees overseeing the program estimate that the trust fund will be depleted by 2034, at which point benefits will have to be cut to 77% of current levels.

To help preserve current projected benefits amounts, changes will have to be made to the system — and the sooner the better. There are a few articles & proposals available online that the Biden Administration has floated to help correct the problem. All these comes along with additional changes it may be eyeing for the future. More updates are to come this year.

Main Benefit Increase on Social Security

Looking the economy, one of the major changes the Joseph Robinette Biden Jr Democrat Party Administration wants to make to Social Security will actually increase its responsibilities. To be more specific, Joe Biden really wants to increase benefit amounts of retirees to a minimum of 125%. This percentage mitigate the federal poverty level for those who have been in active at work or given a least 30 years of service.

As a matter of fact, this 125% minimum benefit would apply to every worker regardless of their salary history. For those people who has about 20-year work records, are expected to see their benefits grow up by 5% flat. On the other hand, widows and widowers would receive about 20% extra increase.

Other Credit Union Guides

- Central Coast Federal Credit Union Loans

- Coast Central Credit Union – Create Account

- Federal Credit Union Near Me – Find Nearest Credit Union Branches & ATM

Social Security Taxes on Earning of $400,000 and Above

We all know that the Social Security is largely funded by payroll taxes of 12.4% on current workers scheme. This is divided into two and half of this is paid by employers. That is to say, the workers typically pay just 6.2% from their salary. But if you’re self-employed, you will be responsible for both the employer’s and the employee’s share taxes.

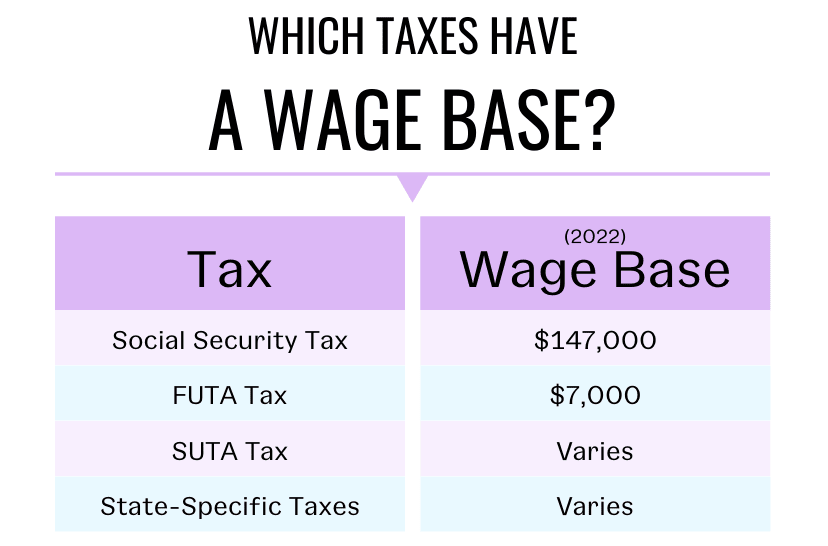

Wage Base

Bear in mind that, this Social Security Tax applies only up to a specific level, called the wage base.

“A wage base, or threshold, is the maximum amount of an employee’s income that can be taxed in a calendar year.”

However, this said-amount can change periodically depending on the rate of inflation & GDP. Currently for the year 2022 for example, was previously the wage base was $142,800 but will now be is $147,000. This simply means that; for people who earn more than $147,000 this year, those excess earnings are exempt from Social Security taxes. Do you understand the logic?

Another key proposals of President Joe regarding Social Security is to apply Social Security taxes to people earning $400,000 or even more. Now, in this framework, as a worker, you would be required to pay Social Security taxes up to the current wage base which is $147,000.

Furthermore, you will not be included to pay additional taxes on earning/income between $147,000 and $400,000. Immediately you reach that $400,000 peak level, taxes would apply to any additional earnings you get. To be sincere, this can create a so-called “donut hole” in which no additional Social Security taxes would be due on earnings between $147,000 and $400,000. See below for more explanation.

What is a Donut Hole?

A donut hole is an US and Canada insurance, welfare, and tax slang. It is an income bracket where one is without benefits, even though benefits are available in the next lower and next higher brackets.

Rising Wage Base

Social Security wage base is usually adjusted every year depending on changes in the inflation rate of the economy. Among the different proposal that has been flying across the Congress in several forms is the wage base agenda. Over the years, the idea is to significantly increase the wage base, maybe to the $400,000 peak level, or to simply remove it completely.

News coming from the Center on Budget and Policy Priorities, any adjustment on the taxable earnings cap will close amidst 25% and 90% of Social Security’s solvency gap.

Needless to say that, no Congressional change comes without repercussion. In most cases, it comes with unforeseen issues. Take for example; under this case of increasing payroll taxes, some employers of labour may shift worker compensation from the taxable variety to the nontaxable variety. This can come in the form of enhanced — and tax-deductible — retirement benefits. All these will not help to grow Social Security.

Another issue here is the increasing payroll taxes on higher-income workers. Why? It will decrease the benefits those workers ultimately receive from the program as a percentage of their monthly income. Meaning that, higher-income earners will be paying more taxes on a proportional basis. But much of that benefit would funnel down to lower-income workers. Do you see?

Similar Posts

- Prevent Yourself from Falling into Charity Scam & Fraud This Holiday Season

- How to Get my Credit Score from 500 to 700 and Above – Best Strategy

- What are the Best Steps to Lower Your Credit Card Interest Rate?

- How to do Transfer Credit Card Balance from one Card to Another

- Credit Score Reports is Your Financial Future & Billing Trust

What Changes Are Likely?

In America, the Democrats and Republicans have been arguing over the years about how to “fix” Social Security. Concurrently, they have been approaching the matter from very different perspertives. Notwithstanding, both sides generally agree that something must be done to move up Social Security in United States.

Just as it is with any political process across the world, compromise is a necessity. So, it’s unlikely that President Joe Biden will be able to achieve all he seeks in terms of Social Security modifications in the US. But some combination of reduced benefits and/or higher taxes likely will be required to lastly reach a compromise.