This article focuses on 8 Common Zelle Scams you really have to watch out for to protect your money and bank account from scammers and fraudsters.

Simply because Zelle is a very fast & easy way to send and receive money online, it has become one other easy way for hackers to steal using it. They can trick you in diverse ways to make you send money to them. This article will show you how to protect yourself from Zelle scams.

During this COVID19 pandemic, it became more normal for contactless payments. The use of digital wallet as well as other online payment options popped out everywhere. This includes every other business places that we know accept cash only. For example, people like fresh farm stands owners, fairly used garage parts sellers and even your hourly babysitter accepts cash only. While this trends is being incredibly convenient for everyone, it has become an opportunity for scammers to attack unsuspecting individuals. Day by day, unsuspecting people are becoming victims of scams, and wherever we turn, there seems to be another new one. There are now cash app scams, online dating scams, Venmo scams, Facebook Marketplace scams, common Zelle scams etc. As far as you make use of the internet for online transactions, you’re always vulnerable.

A Guide to help you stay safe from online Scam

“Presently over 100 million American people make use of Zelle to transfer nearly $500 billion annually. This is a heavy amount of money,” says Eaton-Cardone Monica, COO of Chargebacks911. “Therefore, it is natural to be a risk, when you have that many people transferring that much money, it’s definitely gonna to attract the attention of online scammers, hackers, criminals and cyber-thieves.” These are people who wants to steal your money.

Now, to the aim of this article. For us to guide you and to help you stay safe out there, we’ve identified the most common Zelle scams you might encounter daily. Furthermore, we’ve as well as made provision of some vital guide and useful information on what to do if you fall into any one of them them by mistake.

Always remember this: scammers in general are sneaky people, but if something seems off about a monetary transaction with anyone, it probably is because its a red flag. Trust me; its a scam.

What is Zelle?

Zelle is a common P2P (peer-to-peer) system attached to banking apps. It allows you to send or collect money quickly & more conveniently from your credit card or bank account. The only requirement is for you to simply enter the recipient’s phone number or email address. Thats all. Zelle was created in 2017 by the company Early Warning Services (EWS), which is owned by seven of the biggest banks in the United States, including Bank of America, Truist bank, Capital One as well as other banks in the United States. As we speak, several hundreds of financial institutions including credit unions and banks across the world now offer Zelle as a service.

Apart from its simplicity and ease of usage, Zelle’s main advantage is the speed at which money can be transferred to the receiver. Its faster that traditional financial transfers, such as bank wire transfers (across the counter transaction), which can take a day or longer to process. Brian Contos, Chief Security Officer of Phosphorus Cybersecurity in Nashville says; “Zelle transfers is completed instantly”. “That simply means, once you’ve made successfully made a Zelle payment to someone, the money is sent out of your own account to the person. It is essentially gone—with no way to stop the transaction any longer.”

Notably, Zelle transactions only works with debit cards and bank accounts. The sole aim of its design is to move money from one bank accounts to another. Therefore, in that sense, Zelle is similar to a cash transaction with your regular banking app. “Its not like some other digital payment networks, where your money isn’t kept in a separate account with the service ,” says Alex Hamerstone, Advisory Solutions Director at TrustedSec. QuickTeller and Flutterwave are typical examples too. People are now using it to scam Nigerians.

Who can use Zelle for Transactions?

Basically, anyone and everyone with a bank account at one of the participating banks can register with and use Zelle services. “In fact, anyone can register with Zelle mobile using a Visa or Master Card branded debit card, just open a bank account first,” Hamerstone says. That being said, when anyone is using Zelle, at least one side of the transaction (sender or receiver) must have access to Zelle either through their bank or credit union or through the app.

Going by this, if your bank is partnered with Zelle company, you can see Zelle in your banking app. Secondly, if you’re linking Zelle to a Visa or Mastercard debit card, then you’ll need to download the Zelle app to get started. Its just the same way you do it for Paypal Online Payment too. Thirdly, If you send money through Zelle to someone who isn’t enrolled, they’ll get a notification telling them how to receive the money. This is another way that scammers use to steal your money. Make sure you contact Zelle directly to verify if you have an account with them.

One important note: You cannot send money abroad as Zelle isn’t available overseas and can’t be used for international transactions. Know this and have peace.

What are some common Zelle scams to look out for?

We are very happy for the good news that Zelle is continually improving their top-tier security protocols, says Adam Levin, host of the “What the Hack with Adam Levin” podcast. But what is the bad news? Fraudulent scammers are always creative, convincing and is continually looking for loopholes ready to deceive unsuspecting people. Be wise and at the same time, be careful because once you send money, you have little recourse to recoup it. It is completely gone. Ted Rossman, a senior industry analyst at Bankrate says in his interview that; “Zelle’s main vulnerability is that payments are instant and irreversible”. “Even though people love making payment seamlessly & getting paid quickly, it can be an issue if anything goes wrong. Take for instance—, if I’m reimbursing a work colleague for my share of a meal—and fraudsters exploit this vulnerability, how will I pay for the food?”

Another worry is if you lose your phone without a password and have the Zelle app, a criminal can initiate transfers from your account and make withdrawals. But that not the scenario in this case, but in the majority of cases, “Zelle scams boil down to trickery,” Contos points out. “Most of the reports we have seen, Zelle scams always involve scammers using social media to engineer a victim into transferring money to their criminal’s account.” The same is often true of scams involving Paypal, Apple Pay and Google Pay etc.

- 10 Best Personal Loan You can Apply for with Low Interest Rates

- Best Ways to Prevent Fraud on Credit Card with Identity Theft Detection

- 10 Best Credit Cards without Yearly Service Charge – No Annual Fee Debit

- How to Dispute and Resolve Debit Dispense Error or Credit Report Error

These are the most common Zelle scams:

1. Impersonation scam

People impersonate other people because they want to carry out one crime or the other. Impersonation is probably the most common scam presently on the rise, according to experts, and it comes in diverse ways. People are wicked because of money. We have seen cases where a scammer will impersonate a friend or family member just to scam them. They can even say they (family member) have an emergency and need money right away to treat them. This urgent request for money to help your friend may come in form of an email, text message, direct message. Also, they can use social media site to contact you or even put a phone call across to you.

In other cases, cyber criminals usually impersonate a legitimate company, nonprofit organization or even government agency and request a payment from you via different means including Zelle. “They could go as far as claiming late payment fees for a credit you took. Others can say that you owe them money for a past due charge. Some will say that your water bill payment is late and the service will be stopped if you don’t pay immediately.

Cases has been reported, where some say that you were short on your taxes, or that you failed to pay a traffic fine and a warrant will be issued for your arrest,” says Contos. “Some Americans has complained that they could also claim to be a charity org, a family member who is stranded and in desperate need of help, or use any other scam tactics that will pull at your heartstrings.” For Your Information, be aware of these scam phone numbers because they usually look similar to the original ones.

2. Romance scam

In America, Canada, Australia and some European countries, Cat-fishing or “romance” scams are also on the rise. Seriously, they’re the most common Zelle scams in recent times says Joe Troyer, CEO of ReviewGrower. Last year alone, the Federal Trade Commission says that, “people sent over $547 million to online romance scammers locally or overseas”. In the long run “people have reported losing a staggering $1.3 billion to romance scams, in the past five years. This is more than any other FTC fraud category, the report says.”

Scammer usually target lonely people looking for love. “First, it all begins with a fake dating profile on one of the many popular social media sites or apps,” Troyer says. “Millions of people unknowingly exchange chats/texts with the fraudsters. Most of these online profiles are charming and can make people fall in love with them. From there, they usually start asking for money or presents, often requesting cash through Zelle.”

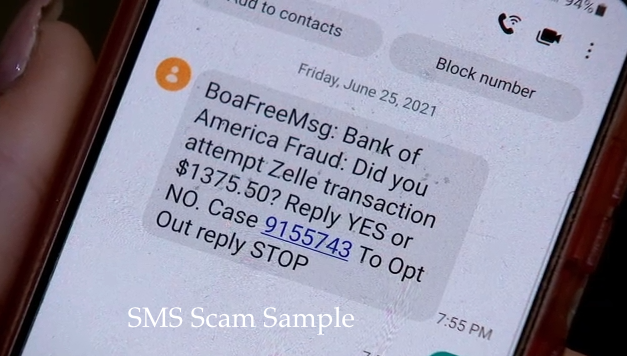

3. Phishing scam

Phishing scam allows fraudsters to gain access to your phone or computer and steal information to empty your bank account. How do they do this phishing scam? Daniel Chan, Chief Technology Officer of Marketplace Fairness explains it for better understanding. He said; “in this scam, scammers send emails or text messages that appear to be from a participating financial institution, asking users to click on a link or open an attachment.” “Now, if the user does this, they may download malware into their computer that can steal their personal information.”

Over the years, the FBI warns about these phishing scams that “can lure you in and get you to take the bait,”. They also gave vital notes that any ploy that leads a victim to giving a scammer access to their Zelle account is extra risky. Reason is simply because Zelle payments are fast and irreversible even though its main purpose is only to be used between people who know and trust each other.

4. Fake invoice scam

As the name implies, scammers send emails or text messages with false invoice that appear to be from a business that you do business with. “The email or message sent by the fraudster will instruct you to click on a link to view a payment invoice,” Chan says. “If the you clicks on the link, you’ll be taken to a website that looks like the business’s website. However, this website is a scam site, and if you enter any of your personal information there, it will give the scammers access to their email account or even your computer.”

5. Lottery scam

The lottery scam can be used for any prize to deceive people eager to travel abroad for free or those who likes playing a betting game. Therefore, in this scam, emails or text messages appear to be from a lottery company. It can even be a company offering a prize of some sort to individuals. However, the email or message will usually ask you to click on a link to claim their prize. From there, they will request you to enter your Zelle account details to receive the “lottery winnings.” Its works just like the fake invoice scam, if you dare clicks on the link in the mail, you’ll be taken to a website that looks similar to the lottery company’s website. When at this website page, if you enter your personal information, the website backend will give the scammers access to their account.

6. Malware scam

This is an attack on your computer to steal vital information. Mr. Paul Bischoff, a privacy advocate at Comparitech, warns people against clicking on links or attachments in unsolicited emails or texts. Why? Its because they could install malware on your device to enable them steal vital documents. “You will be completely tricked into installing malware into your device,” Bischoff says. “Secondly, and an online attacker could hijack your device and send themselves money from your Zelle app.”

Going by this, that’s not all. “There are some advanced coded malware that could hijack banking apps like Zelle and send money directly from your account to theirs,” Bischoff adds. “While on the other hand, some malware might just wait for you to log in to your bank account via a web browser so it can steal your username & password and send it to the attacker. In the same vein, another type of malware might simply redirect you to a phishing website when you try to access your bank’s website or Zelle, Venmo, Cash App, Google Pay, Apple Pay etc for example, which then steals your password and other info.”

7. Goods-and-services scam

Jim Murphy, Director of Fraud Management North America at D4t4, also warns against the goods-and-services scam. “This happens when you shop online and pay using Zelle and never receive what you paid for,” Murphy says. “The item is usually listed at a discount but only if it’s purchased within a limited time window.”

As Hamerstone warns, be wary of companies or individuals with products that are priced low or are hard to find—and who then push you to pay via Zelle.

8. Emergency phone scam

“Another thing to watch out for is someone asking to use your phone,” Hamerstone warns. “There have been cases where someone will fake an emergency, ask to use a stranger’s phone and then quickly send a payment to themselves.”

Trending Articles for Credit Card Guide

- CCFCU Loan Interest rates – Central Coast Federal Credit Union (Auto, House and Personal)

- Coast Central Credit Union – Create Account and Login with Customer Service Guide

- Cash Advance Services Near Me – Best Instant Cash Advance Loans Matching Services

- Federal Credit Union Near Me – Find Nearest Credit Union Branches & ATM

- Fraud Detection Algorithms Using Machine Learning and AI

Can Zelle refund my money if I’m scammed?

Because Zelle is intended to be used between people who know each other, and the money goes directly from one bank account to another, there is little to no protection at this time if you fall for a Zelle scam.

“It is important to note the difference between fraud and a scam. In short, if someone gets access to your account without you being involved in any way, that is considered fraud, and you will generally be able to get your money back,” Hamerstone says. “But if you are the victim of a scam—where you are tricked into sending someone money, whether for a product or service that you never received or never even existed—then you are unlikely to get your money back.”

In general, before signing up for any service, read the fine print when it comes to a company’s fraud protection rules. “While PayPal offers significant protection from fraudulent transactions, Zelle, for example, does not offer such protection,” says Steven J.J. Weisman, a lawyer and professor of white-collar crime at Bentley University. “That is why these services should never be used for commercial transactions but only to transfer small amounts of money to people you know.” Similarly, you likely won’t be able to get your money back if you fall victim to a gift card scam.

Related searches

- Common zelle scams refund

- Facebook marketplace bank transfer scam

- Is facebook marketplace safe with Zelle?

- Is zelle safe to receive money from strangers

- Common zelle scams business account

- Facebook marketplace common zelle scam news

- Is zelle safe to receive money from strangers reddit

- New but Common zelle account limit email

What should you do if you’ve fallen for a Zelle scam?

First off, if you’ve been the victim of fraud or a scam, you should report it immediately online to the FBI Internet Crime Complaint Center. Secondly, you can call the FBI’s toll-free fraud hotline at 833- FRAUD-11. Furthermore, if you are enrolled in Zelle through your bank, you’ll also need to contact them for confirmation of transactions. But if you’re enrolled with the Zelle app, you can goto the official Zelle website and fill out their online form or call 844-428-8542.

In the same vein, if you report a Zelle scam immediately, you may get your money refunded in full. But these dats, some banks are taking the position that the Electronic Transfer Act which simply does not apply to many victims of Zelle scams. In such cases, “it becomes a pointing-finger matter,” says Andy Rogers, a senior assessor at Schellman, a cybersecurity company. “Zelle will point to your bank as the one that should do the refunding, and your bank points back to Zelle as the one who should refund the money.” At the end, you get nothing.

How do you avoid these Common Zelle scams?

Anyone can be vulnerable to scam. But, while anyone can be faced with Zelle scams, there are ways to protect yourself—namely, by familiarizing yourself with the methods criminals may use to trick you. Trust me; if you get a message with any of the following red flags, there’s a good chance it’s a scam.

1. A sense of urgency to solve a problem

“Almost all scams involve instilling a sense of urgency in victims,” Bischoff says. “If you feel rushed to make a decision, there’s a strong chance it’s a scam.”

2. Unsolicited texts or emails or calls

From experience, I advise that you never, ever click on links or attachments in unsolicited texts or emails. “If you’re unsure whether an email is legitimate, Google your bank’s phone number and call that instead of the number listed in the email,” Bischoff advises.

3. Only one payment method accepted

With the rise in technology, most legitimate businesses accept multiple payment methods. “ So, if Zelle is the only one available to you in a transaction,” Bischoff says, “it is possibly a scam.”

4. Requests for sensitive information

“To avoid having your Zelle account and other accounts taken over by hackers, never provide your personal information in untrusted websites. Don’t enter your username, password or PIN in response to any email, text message or phone call unless you have absolutely confirmed that the request for this information is legitimate, which it never is,” Weisman says. “Even if you get a call that appears to come from your bank or other company with which you do business, always confirm it. Because, your True Caller ID can be tricked by spoofing to make the call appear legitimate when it is definitely not.”

Conclusion

Note: ZELLE IS NOT THE SCAM. The scam is what scammers try to do once they get your Zelle information. There is a viral TikTok video online, where a woman warns other Facebook Marketplace users of rampant Zelle scams on the platform and shares her own experience.’ She is a New York-based woman. She’s a TikToker Tori (@self.timer.tori) and she is trying to sell her queen-size bed and canopy bed frame on Facebook Marketplace. However, the majority of responses she’s gotten so far are from scammers using an innovative scheme involving Zelle. She has this to say; At least eight people have already tried to scam me’: The article titled “TikToker warns against Zelle scams on Facebook Marketplace”will appear in our next post.

Sources:

- Monica Eaton-Cardone, COO of Chargebacks911

- Brian Contos, Chief Security Officer of Phosphorus Cybersecurity

- Alex Hamerstone, Advisory Solutions Director at TrustedSec

- Adam Levin, host of the “What the Hack with Adam Levin” podcast

- Ted Rossman, senior industry analyst at Bankrate

- Joe Troyer, CEO and growth advisor of ReviewGrower

- FTC: “Reports of romance scams hit record highs in 2021”

- Daniel Chan, Chief Technology Officer of Marketplace Fairness

- FBI: “Spoofing and Phishing”

- Paul Bischoff, a privacy advocate at Comparitech

- Jim Murphy, Director of Fraud Management North America at D4t4

- Steven J.J. Weisman, a lawyer and professor of white-collar crime at Bentley University

- Andy Rogers, senior assessor at Schellman

- Amazon Scams to Avoid at All Costs

- What Is a Brushing Scam?

- How Doxxing Sets You Up to Be Hacked

Editorial Note: This content is not provided by Zelle Banking Company. Any or all opinions, analyses, reviews, ratings or recommendations in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by Zelle. Lastly, the sole purpose is to guide users.